BetaShares Asia Technology Tigers ETF (ASX: ASIA) is an exciting ETF to watch for at least two reasons.

About ASIA

There are plenty of ETF options to invest into western technology businesses. However, there aren’t many ways to get invested into the Asian tech giants.

ASIA aims to track the 50 largest tech and online retail shares in Asia, outside of Japan.

Businesses like Alibaba, Tencent, Baidu and JD.com are leading Asia’s shift to a technological world. Asia is rapidly adopting technology and there is plenty of growth.

However, the biggest holdings are currently Taiwan Semiconductor Manufacturing and Meituan Dianping.

Other similar ETFs

There aren’t many ETFs like ASIA. There are ETFs that focus on the broader Asian share market like Vanguard FTSE Asia ex Japan Shares Index ETF (ASX: VAE) and iShares Asia 50 ETF (ASX: IAA).

But if you’re wanting the biggest exposure to the Asian tech giants, then ASIA is the choice that gives that.

How has the ETF performed?

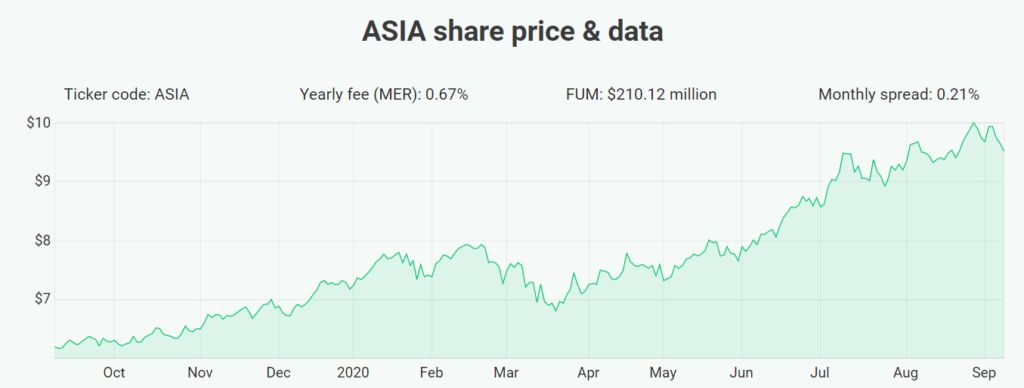

The ETF may have an annual cost of 0.67% (which is somewhat high for an index-based ETF), but its net returns have been very strong. Over the past six months it has risen 28.5%, over the past year it has gone 58.65% and since inception in September 2018 it has returned 28% per year.

Why I like it

ASIA clearly has a lot of growth potential. The Asian tech shares could be just as good (if not better) than the US tech shares. We should want our portfolio to be invested in the businesses that will deliver the best returns.

Adding this ETF would add diversification that many investors simply don’t have. Asia is a big economy, but it’s under-represented in portfolios.

However, I’d be cautious about China risks – so I’d only buy a relatively small parcel at this valuation.

But there are plenty of other ETFs out there for growth and/or dividends. Check out our list of ASX ETFs.

[ls_content_block id=”695″ para=”paragraphs”]