I believe that Warren Buffett would be a fan of investing in iShares S&P 500 ETF (ASX: IVV) if he were Australian.

About IVV

As the full name may suggest, this ETF aims to track the S&P 500. That’s an index based on 500 of the biggest US businesses.

I’m sure you’ve heard of many/all of its biggest holdings including Apple, Microsoft, Amazon, Facebook, Alphabet (Google) and Berkshire Hathaway.

It has an annual management fee of just 0.04% per annum, which is one of the cheapest available on the ASX.

Other similar ETFs

There are other ETFs that focus on giving exposure to a large number of US shares like Vanguard U.S. Total Market Shares Index ETF (ASX: VTS), though the Vanguard one gives exposure to a few thousand businesses, not just 500.

How has the ETF performed?

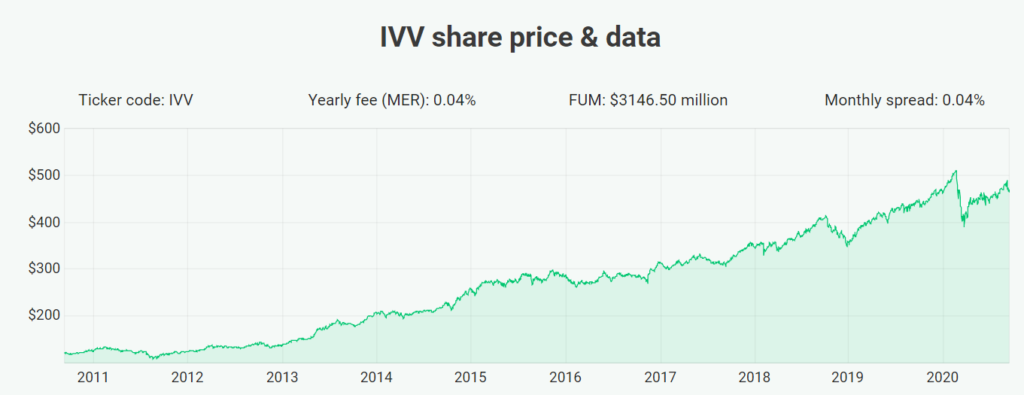

As you can see, it has been a strong performer over the past decade. Over that period its net returns has been an average of 17.15% per year.

Why Warren Buffett would be a fan of IVV

Warren Buffett himself has said that people would do well by just investing in the S&P 500 and letting it grow over time.

The broad diversification is attractive. Many of those US giants like Alphabet and Microsoft are global giants, not just US businesses. It has good earnings diversification. Past returns aren’t a guarantee of future returns, but it shows how strongly these tech shares have grown.

It offers almost everything you could want from an investment, though it doesn’t have a high dividend yield with a current yield under 2%. Having their HQs in the US could be a negative depending on what happens next in the shorter-term. Otherwise, it seems like a solid long term investment idea.

But there are plenty of other ETFs out there for growth and/or dividends. Check out our list of ASX ETFs.

[ls_content_block id=”695″ para=”paragraphs”]