This short article explains which types of investments our team (or another investor) would consider a ‘satellite’ or ‘tactical investment‘ and what might be considered a ‘core investment’.

How to build a diversified portfolio

So you’ve got your brokerage account set-up? Check.

You’ve got some cash set aside to invest? Check.

And you’ve got some great shares or ETFs on your list? Check.

But how does an investor combine all of the shares and ETFs together in a rock-solid portfolio?

The answer: we use a Core & Satellite approach.

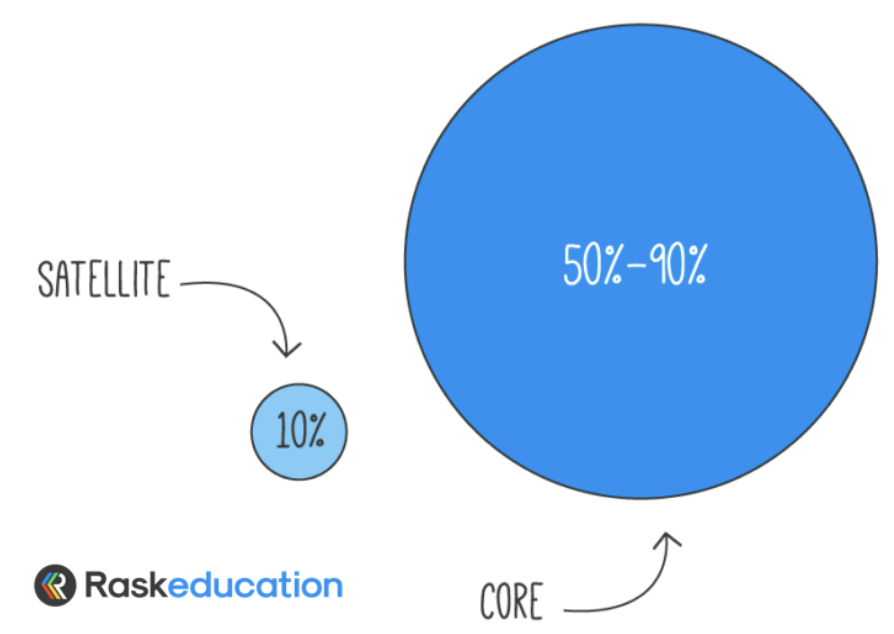

The Core & Satellite approach combines conservative and reliable long-term investments (in the Core) while also helping beginners invest – without putting it all on the line – in ‘higher risk’ tactical/satellite investments.

Where to start

Every investor should know that the important part of his or her portfolio is the Core.

The Core of an investment portfolio will consist of:

- Lower risk investments

- Long-term investments (e.g. 5+ year positions)

- Low-cost investments (e.g. low-cost index funds and ETFs, established managed funds, or other assets)

For example, large and established managed funds, low-cost share ETFs, bond ETFs, cash ETFs, dividend shares, and even things like investment property could be considered ‘Core’ positions for a portfolio.

At Best ETFs Australia, we consider Core investment to be ETFs or funds that are low cost, reasonably predictable (based on historical returns), and part of traditional asset classes (shares, bonds, etc.).

Imagine an investor who is starting out today has $5,000 and plans to invest $1,000 every month. Using the Core & Satellite approach, the investor might start with the Core positions, including a couple of ETFs, blue-chip shares, managed funds or other reliable investments.

A tip from Rask Australia: Try getting one or two years’ experience, or set a target investment amount (e.g. $50,000) before you start adding ‘Satellite’ investments to your portfolio.

Tactical ETFs & Funds

This part of portfolio construction is optional but encouraged if investors want to take an ‘active’ approach to their investing.

Once an investor has a few years of experience in the share market, and only if they are comfortable taking more risk with smaller or riskier positions, they can consider adding Satellite positions.

Satellite or ‘tactical’ positions are smaller than Core positions. For example, if a low-cost index fund or ETF in the Core is 5% of a portfolio, a ‘Satellite’ position might be 1% or 2%.

We believe a Satellite investment could be anything that:

- Is higher risk

- Has higher fees (e.g. more than 1% per year)

- Is not reasonably predictable (e.g. Bitcoin, shares bought as part of a trading strategy, etc.)

- Has a strategy that we consider to be exotic, new or specialised

At Best ETFs Australia, we consider any strategy that is an exotic, specialised, new, or one that is less predictable (compared to historical standards); and most smaller ETFs, as tactical ETFs.

Examples would include rules-based or “smart beta” ETFs, including some equal-weight ETFs, small-cap ETFs, higher risk individual shares, leveraged or geared products, cryptocurrencies, short-term positions, ETFs launched within the past three years, or anything outside of traditional asset classes and strategies.

In other words, anything that’s not in the Core.

After 2-3 years, as an investor’s experience builds and his or her portfolio grows, they might get to a point where they can commit some of their investment monies to their Core and some to their Satellite or tactical positions. Tactical/satellite positions are optional.

We think that having only ‘Core’ holdings is probably the best thing for most investors.