When a fund/ETF has a “domicile” of Australia it means it is a registered fund in Australia for tax purposes. Tax domicile is an important consideration for investors using ETFs or managed funds to invest in overseas markets as funds can be ‘registered’ overseas but accessible here in Australia.

A fund/ETF with a tax domicile of Australia is formed, registered and regulated in Australia.

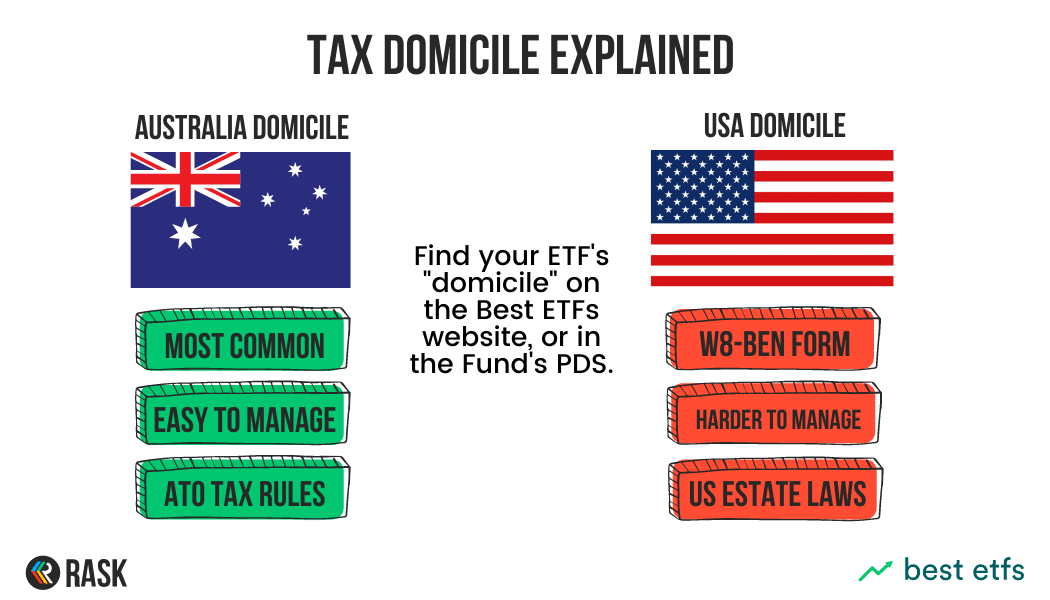

If you invest in a fund that is regulated here in Australia (Australia domicile), you should not have to fill in or file additional tax or legal documents with the ETF issuer or your broker, such as the pesky W8-BEN form.

Which domicile is best for me?

For Australian tax residents, if you have the choice of two ETFs that are exactly the same but one is Australia domiciled and the other is US domicile, consider the Australia domiciled ETF. Using Australia domiciled ETFs or funds simply means less paperwork, less direct exposure to foreign tax or estate laws, potentially fewer legal implications, and — as a result — fewer headaches.

The tax information on your chosen fund can change, so you should always read the Product Disclosure Statement (PDS) to learn where your chosen ETF is domiciled. Then consult a financial adviser and tax agent if you’re confused. They will be able to tell you what this information means if you’re still confused after reading the PDS.