There are a few quick reasons why I like BetaShares Australia 200 ETF (ASX: A200).

About A200

You may have already guessed that A200 is invested in 200 Australian businesses. That means it offers a good amount of diversification. The biggest positions in the ETF are the biggest in the ASX 200 – which is what the ETF is essentially tracking.

Its largest holdings are businesses like CSL Limited (ASX: CSL), BHP Group Ltd (ASX: BHP) and Commonwealth Bank of Australia (ASX: CBA).

Other similar ETFs

It’s not the only ETF that looks to essentially track the returns of the ASX. There are other examples like Vanguard Australian Shares Index ETF (ASX: VAS) and iShares Core S&P/ASX 200 ETF (ASX: IOZ).

How has the ETF performed?

COVID-19 caused a lot of difficulties for some of A200’s biggest holdings. Particularly the big four ASX banks like Westpac Banking Corp (ASX: WBC) and National Australia Bank Ltd (ASX: NAB).

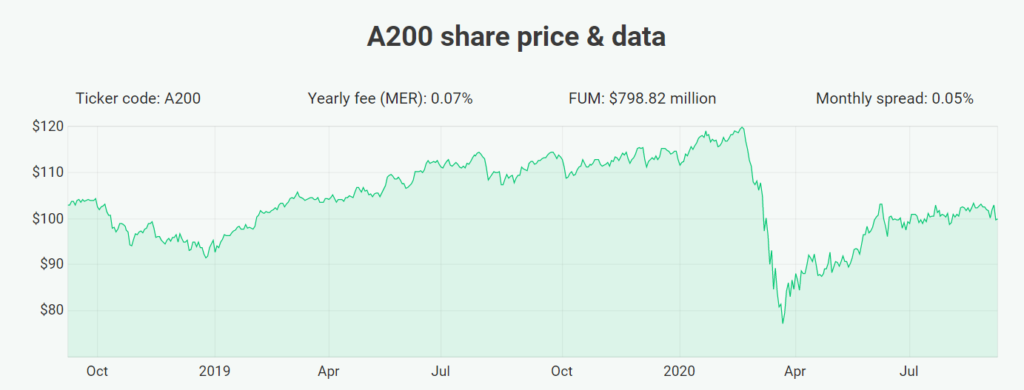

Including dividends, A200 has seen a negative return of -5.38% over the past year and a positive return of 3.76% per year since inception on 7 May 2020.

Why I like it

There are three reasons.

First, it offers good diversification. Owning a piece of 200 businesses is a lot better diversification than a portfolio of just four big banks, Telstra and perhaps a miner or two.

Second, it’s very cheap. It has an annual management fee of just 0.07%, which is the cheapest that Aussie investors can get.

Third, it may have a relatively large dividend yield once COVID-19 impacts pass. ASX shares are known for being big dividend payers.

But there are plenty of other ETFs out there, some have much better capital growth prospects. Check out our list of ASX ETFs for other ideas (just search for ASX ETF).

[ls_content_block id=”695″ para=”paragraphs”]