BetaShares S&P/ASX Australian Technology ETF (ASX: ATEC) has been high-performing ETF since 23 March 2020. There’s one key reason to buy it.

About ATEC

ATEC provides exposure to leading ASX businesses in a range of tech-related market segments like IT, consumer electronics, online retail and medical technology.

What are some of the names that it’s invested in? Its biggest holdings, in order, are: Afterpay Ltd (ASX: APT), Xero Limited (ASX: XRO), SEEK Limited (ASX: SEK), Computershare Limited (ASX: CPU), REA Group Limited (ASX: REA), Nextdc Ltd (ASX: NXT), Carsales.Com Ltd (ASX: CAR), WiseTech Global Ltd (ASX: WTC), Altium Limited (ASX: ALU) and Appen Ltd (ASX: APX).

But ATEC also owns gives a (very small) exposure to names like RPMGlobal Holdings Ltd (ASX: RUL), ELMO Software Ltd (ASX: ELO), Volpara Health Technologies Ltd (ASX: VHT) and Audinate Group Ltd (ASX: AD8).

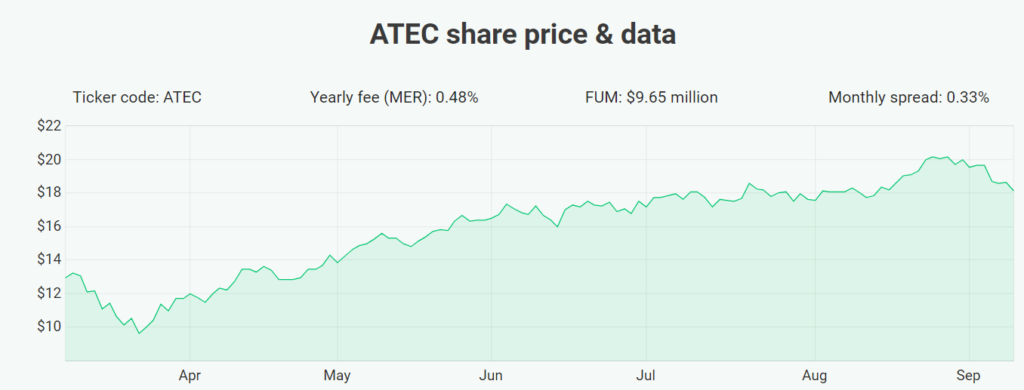

it has an annual management fee of 0.48% per year.

Other similar ETFs

The ETF is fairly unique on the ASX, though there other ETFs that focus on international technology businesses like ETF Securities TECH ETF (ASX: TECH), BetaShares NASDAQ 100 ETF (ASX: NDQ) or BetaShares Global Robotics and Artificial Intelligence ETF (ASX: RBTZ).

How has the ETF performed?

It was launched during the COVID-19 crash, but it has rebounded strongly since then, its up 93% from 23 March 2020. Since inception it has returned 40.1%. Over the past three months the ETF has returned 23.7%.

1 key reason to buy it

Many of the businesses that ATEC is invested in are great ASX growth shares with higher profit margins. There’s a reason why the ETF has performed so well – because many of its holdings are performing well in this new COVID-19 world. Returns won’t always be this strong, but it could keep outperforming.

However, the biggest five positions make up almost half of the portfolio, Afterpay is 18% of the whole ETF. That’s not great diversification, though if it delivers the returns does it really matter?

But there are plenty of other ETFs out there for growth and/or dividends. Check out our list of ASX ETFs.

[ls_content_block id=”695″ para=”paragraphs”]