There are a few good reasons why Vanguard Australian Shares Index ETF (ASX: VAS) could be the best way to invest into ASX shares.

About VAS

VAS ETF looks to give investors exposure to the ASX 300. That’s 300 of the biggest businesses on the ASX.

The biggest companies in Australia are the largest holdings in the ETF. The biggest positions are: CSL Limited (ASX: CSL), Commonwealth Bank of Australia (ASX: CBA), BHP Group Ltd (ASX: BHP), Westpac Banking Corp (ASX: WBC), National Australia Bank Ltd (ASX: NAB), Wesfarmers Ltd (ASX: WES), Australia and New Zealand Banking Group Ltd (ASX: ANZ) and Woolworths Group Ltd (ASX: WOW).

The above names are all of Australia’s leading ASX blue chips. You get plenty of exposure to them with this ETF.

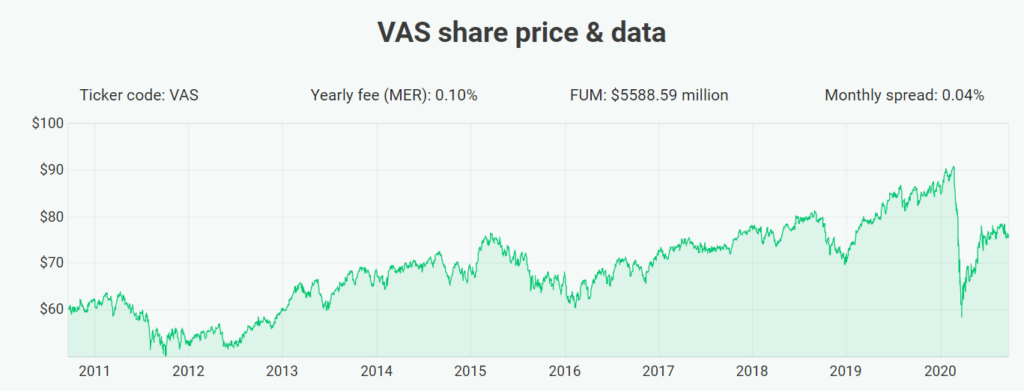

It has an annual management fee of 0.1% per year.

Other similar ETFs

There are other ETFs that are quite similar to the VAS ETF such as BetaShares Australia 200 ETF (ASX: A200) and iShares Core S&P/ASX 200 ETF (ASX: IOZ) which track the ASX 200, which is quite similar to the ASX 300.

How has the ETF performed?

According to Vanguard, over the past decade the VAS ETF has made average returns of 7.6% per year. When you take dividends out of the return, the capital growth has only been around 3% per year.

2 reasons why VAS ETF could be the best way to invest in ASX shares

The VAS ETF has very low annual fees, which means you get a lot of diversification through a single investment for very low fees. That’s an attractive way to invest in ASX shares.

The main difference is that the VAS ETF tracks the ASX 300, whereas the other two major ASX ETFs track the ASX 200. The VAS ETFs gives exposure to 100 more businesses which have more growth potential, though the exposure is limited to small positions.

However, whilst I think VAS could be the best ETF to invest broadly in ASX shares, there are other ETFs I would prefer to buy like Betashares FTSE 100 ETF (ASX: F100).

But there are plenty of other ETFs out there for growth and/or dividends. Check out our list of ASX ETFs.

[ls_content_block id=”695″ para=”paragraphs”]