I believe that investors would be smart to consider investing in Vanguard FTSE Europe Shares ETF (ASX: VEQ) through the rest of 2020.

About VEQ

This ETF gives exposure broad diversification to the European share market.

It actually owns around 1,300 businesses as investments. The biggest European stock exchanges make up the largest markets within the ETF.

UK shares are almost a quarter of the ETF. The other countries with an allocation of more than 1% are: Switzerland, France, Germany, the Netherlands, Sweden, Italy, Spain, Denmark, Finland, Belgium and Norway. It truly is a European-wide ETF.

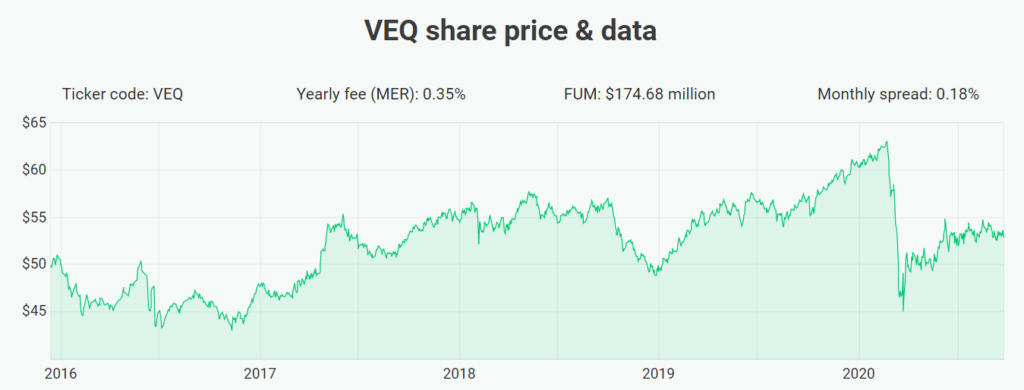

The ETF has a reasonably high cost for a Vanguard investment with an annual management fee of 0.35%.

So what European shares does the ETF actually own?

Its biggest positions are: Nestle, Roche, SAP, Novartis, Unilever, AstraZeneca, ASML, Sanofi, Royal Dutch Shell and LVMH (Louis Vuitton Moet Hennessy).

The above businesses are some of the best in the world. If I were making my own global portfolio I would like to own SAP, Unilever, AstraZeneca, ASML and LVMH. I particularly like ASML and LVMH.

Other similar ETFs

Other European-based ETFs would be the most obvious comparison such as iShares Europe ETF (ASX: IEU) and Betashares FTSE 100 ETF (ASX: F100).

How has the ETF performed?

It has been a tough five years for European shares with Brexit and then COVID-19.

Since inception in December 2015 the ETF has returned an average of 3.6% per year. It was launched just before Brexit, so the time period is not a great period to look at.

The time from Brexit to January 2020 was a period of decent returns.

Why it makes sense to buy VEQ ETF in 2020

Europe is currently seeing a second wave of COVID-19 and restrictions are starting to be implemented again. More lockdowns are being considered, particularly in the UK (the biggest market).

There are good European shares. Those share prices are heading lower whilst the Aussie dollar strengthens (making it cheaper to buy businesses of foreign currencies). There is a double incentive to buy European shares with the current strength of Australia.

But there are plenty of other ETFs out there for growth and/or dividends. Check out our list of ASX ETFs.

[ls_content_block id=”695″ para=”paragraphs”]