I believe that Vanguard FTSE Asia Ex-Japan Shares Index ETF (ASX: VAE) is a really good contender to add good diversification to a portfolio.

About VAE ETF

The VAE ETF is about providing access to the Asian share market outside of Japan.

As you might expect, there’s a large allocation to China with 45.5% of the portfolio. Taiwan has a 13.6% allocation, South Korea has a 12.5% allocation, India has a 9.5% allocation and Hong Kong has a 9.3% allocation.

Other countries with an allocation of around 1% or more are: Singapore, Thailand, Malaysia, Indonesia and the Philippines.

Whilst this ETF owns over 1,300 holdings, you get exposure to some of the world’s best businesses like Alibaba, Tencent, Taiwan Semiconductor Manufacturing and Samsung.

There was good economic growth in Asia before COVID-19 and this could continue over the coming years. China, Taiwan and South Korea appear to have good control of the coronavirus.

Other similar ETFs

Other Asian ETF examples are: Betashares Asia Technology Tigers ETF (ASX: ASIA) and iShares Asia 50 ETF (ASX: IAA).

How has the ETF performed?

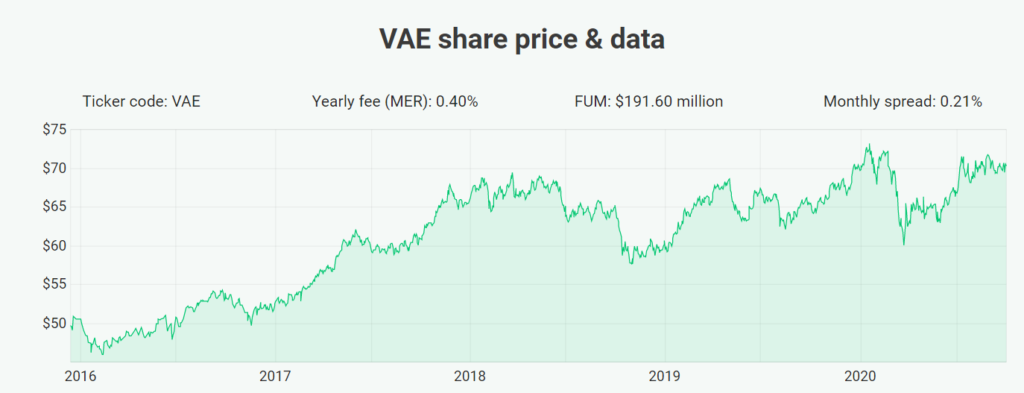

According to Vanguard, over the past year it has produced a total return of 10% (after the annual 0.40% fee) and since inception in December 2015 it has returned an average of 9.7% per annum.

Why it’s a diversification contender

Most Aussie investors have a lot of exposure to ASX shares and probably the US share market.

But Asia is a huge part of the global economy with a number of high quality businesses listed there. I think the Asian tech shares can rival the US tech shares, and they’re probably priced cheaper.

There are China risks with this ETF, but I think it’d be a good way to diversify away from an ASX ETF without necessarily lowering returns. ‘Diworsification’ isn’t a good idea.

But there are plenty of other ETFs out there for growth and/or dividends. Check out our list of ASX ETFs.

[ls_content_block id=”695″ para=”paragraphs”]