The latest exchange-traded fund (ETF) to hit the ASX, Betashares Australian Quality ETF (ASX: AQLT) has been making waves among investors.

It is the little sibling of Betashares Global Quality Leaders ETF (ASX: QLTY), which uses similar criteria to find quality companies outside of Australia.

Quality companies, and therefore ETFs, have been shown to outperform the broader market over time.

But is AQLT better than owning a vanilla ASX 200 index? Let’s find out.

AQLT 101

For a 0.35% management fee, AQLT provides investors with passive Australian equity exposure.

The ETF holds 40 companies, which it has screened for three quality metrics:

- Return on equity – how much a company makes given the amount of equity invested

- Earnings stability – are profits stable, or do they vary from year to year?

- Low leverage – does the business hold low amounts of debt?

Notable inclusions in the ETF include Woolworths, Wesfarmers and CSL.

Under the hood

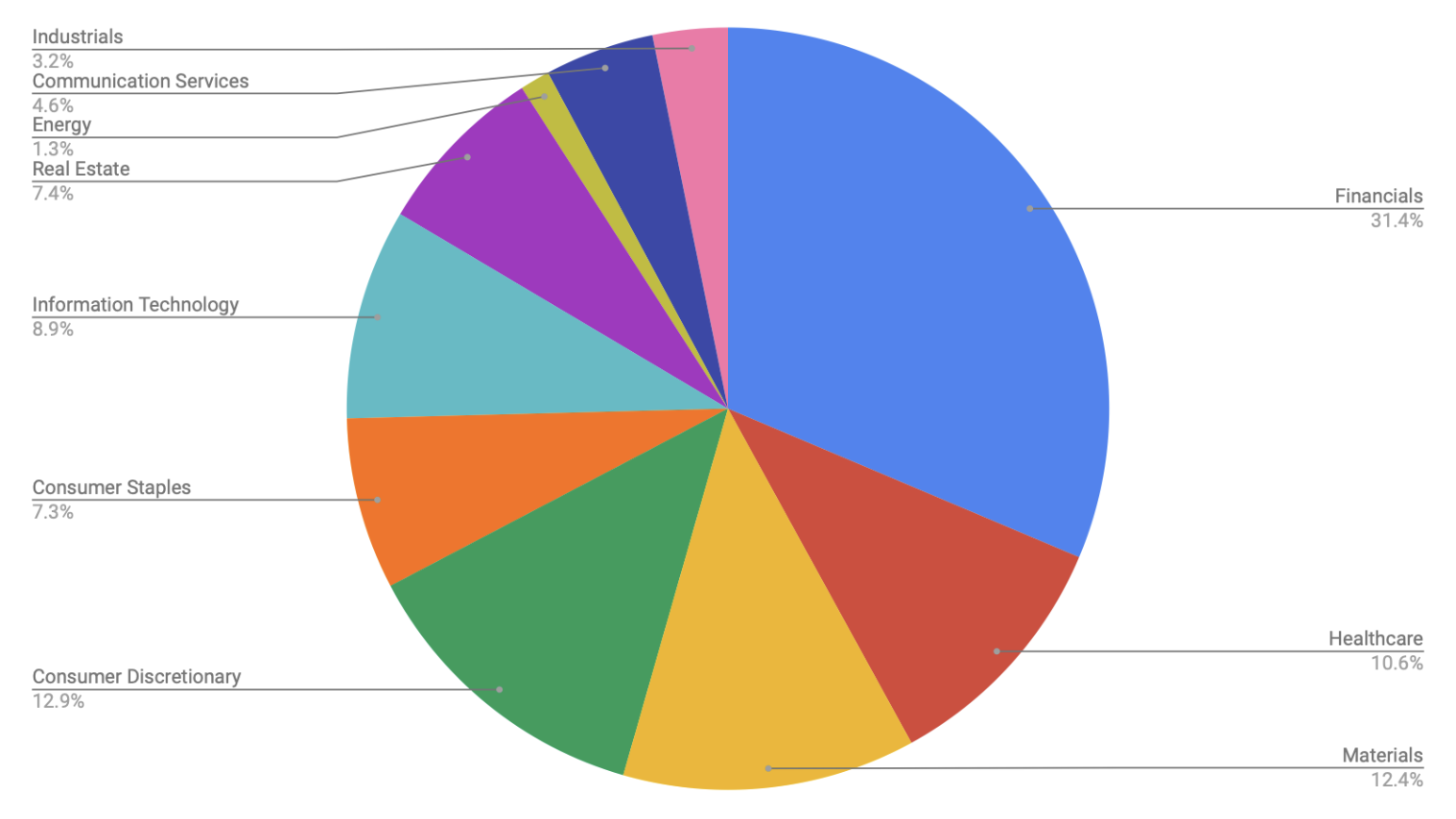

On a sector basis, AQLT has a bigger weighting towards Consumer Discretionary (13%), Staples (7%) and Technology (9%).

This comes at the expense of Materials (12%) and Energy (1%).

Both AQLT and the benchmark index have similar weightings in Financials and Healthcare.

Notably, each holds 24% of the portfolio in the big banks (Macquarie, CBA, Westpac, ANZ and NAB).

Additionally, both indexes are heavily concentrated, with 47% of assets in the same ten companies.

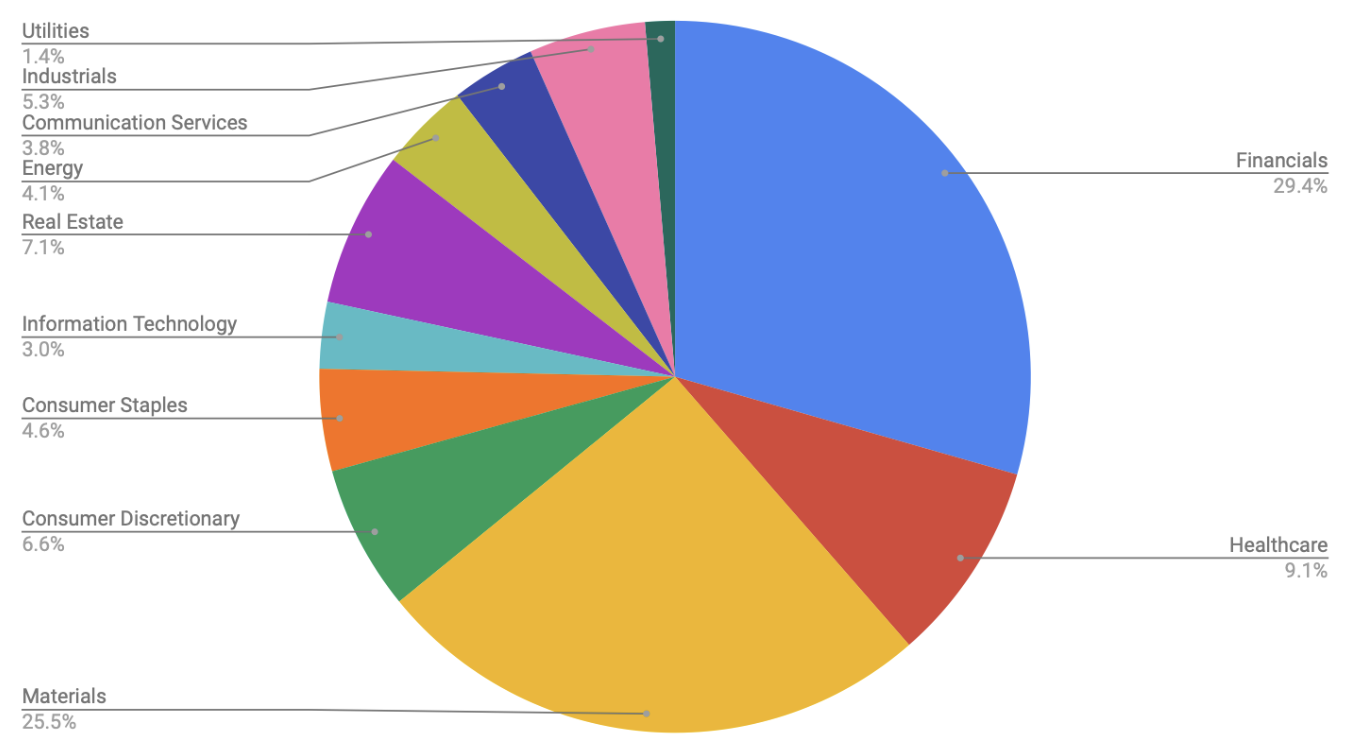

ASX 200

AQLT

Out with the bad, and out with the good?

By screening for quality companies, AQLT naturally removes poor quality companies (no profits, high leverage or high earnings volatility).

This in itself should provide superior performance given it’s removed the poor quality businesses.

But the ETF also excludes several companies that most investors would consider quality such as:

- Xero, the leading accounting software in Australia and New Zealand

- JB Hi–Fi, arguably the best retailer in Australia

- REA Group, owner of property portal realestate.com.au

- Cochlear, the world’s leading designer of hearing implants

Quality filters are great but often fail to recognise businesses that may be reinvesting profits into building the business.

Therefore return on equity looks low, or earnings stability varies, as the business reinvests into opportunities.

Hence, the filter can leave out great companies that don’t meet the rigid inclusion rules.

AQLT or ASX 200?

The major difference between AQLT compared to the ASX 200 is the materials sector weighting.

AQLT has greater exposure to industrials at the expense of energy and mining.

Given the higher management fees, similar concentration in big holdings and absence of what should be considered quality companies, this simply isn’t enough to give AQLT the tick of approval.

Instead, the ASX 200 remains suitable for low cost, diversified Australian equity exposure.