If you see the "Domicile - USA" note on the Best ETFs Australia website it means a fund/ETF is not registered in Australia for tax purposes. That is, the fund might be registered in the United States of America and may expose you to extra tax rules.

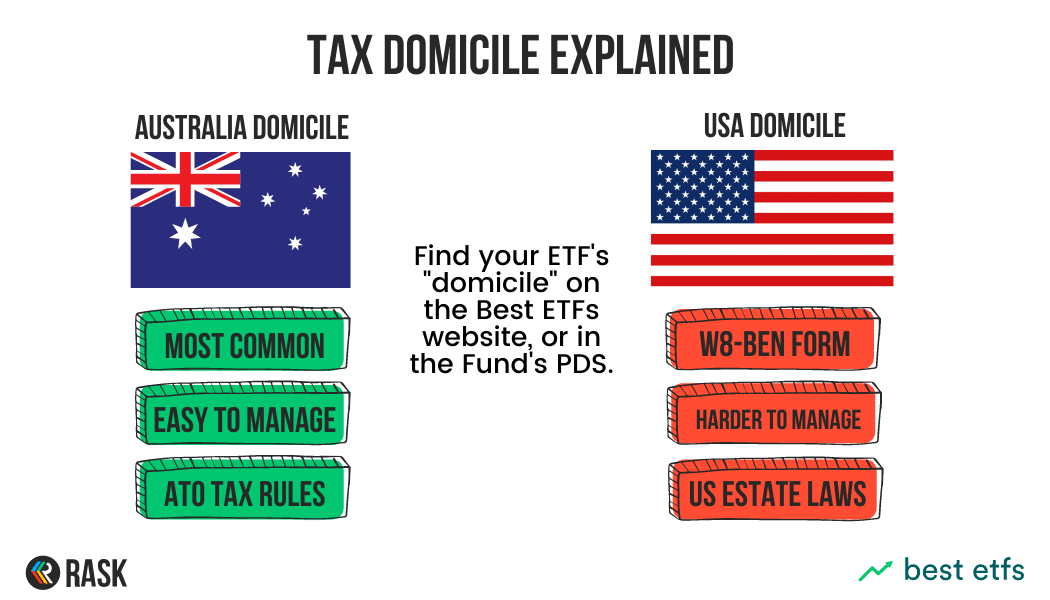

Investors who invest in a foreign domiciled fund may face added (foreign) legal risks, estate planning laws and taxes -- compared to funds or ETFs which have their domicile set to be Australia.

Imagine two ETFs:

The Australian-registered fund, Fund A, will be taxed just like any other managed fund providing investments in Australia. Fund B will be subject to extra laws & tax rules.

For Australian tax residents, if you have the choice of two ETFs that are exactly the same but one is Australia domiciled and the other is US domicile, consider the Australia domiciled ETF. Using Australia domiciled ETFs or funds simply means less paperwork, less direct exposure to foreign tax or estate laws, potentially fewer legal implications, and -- as a result -- fewer headaches.

The tax information on your chosen fund can change, so you should always read the Product Disclosure Statement (PDS) to learn where your chosen ETF is domiciled. Then consult a financial adviser and tax agent if you're confused. They will be able to tell you what this information means if you're still confused after reading the PDS.

The information on this website is general financial advice only. That means, the advice does not take into account your objectives, financial situation or needs. Because of that, you should consider if the advice is appropriate to you and your needs, before acting on the information. In addition, you should obtain and read the product disclosure statement (PDS) before making a decision to acquire any financial product. If you don’t know what your needs are, you should consult a trusted and licensed financial adviser who can provide you with personal financial product advice. Please read our Terms & Conditions and Financial Services Guide before using this website.

“Rask Invest” is considered a financial product and has a Product Disclosure Statement (PDS) and Target Market Determination (TMD), issued by InvestSMART. These documents can be accessed on the Rask Invest website. Please seek professional advice before making any investment decision with respect to Rask Invest.

© Rask Australia 2024