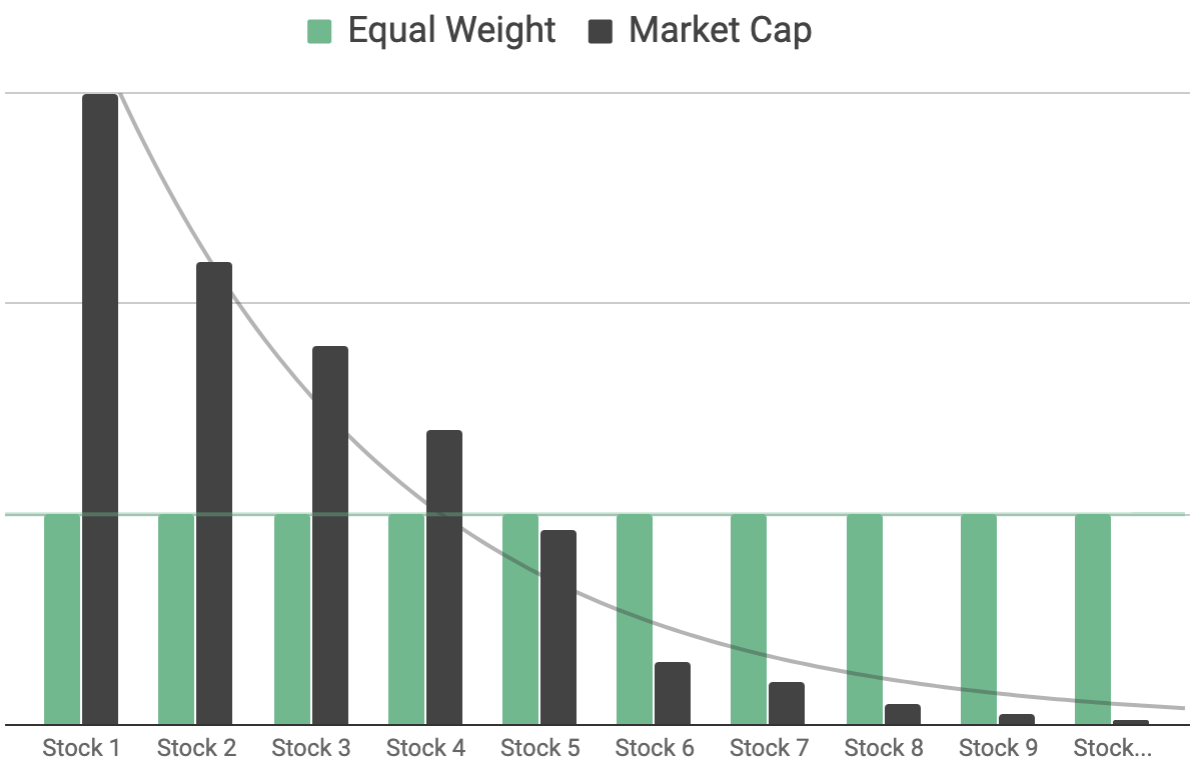

Equal weight strategies are as simple as they sound. If there are 200 stocks in the ETF, all 200 will be bought in equal measures, or 0.5% each. Every so often (e.g. each quarter or every six months) the ETF issuer will rebalance the portfolio.

Equal weight strategies are different from normal index funds because normal index funds use market capitalisation, a measure of a company’s size, to weight shares in the ETF. In a normal index fund, the biggest companies get the biggest position in the ETF.

Equal weight strategies can help investors get more exposure to the smaller shares in the index (e.g. shares 101 – 200 out of the top 200) and less exposure to the largest shares (e.g 1 – 100). Depending on your risk profile, goals/objectives and time to invest, these strategies may not produce a better outcome relative to traditional index funds.

Why equal weight?

Most ETFs use strategies that focus on ‘market capitalisation’, which means the biggest companies (e.g. blue chips) get the biggest position in the ETF/fund. Some researchers believe smaller companies outperform large companies and, therefore, should be a bigger part of a portfolio.

In the Australian shares sector, equal-weight ETFs are popular because the market is concentrated towards the biggest banks/financials and resources companies.

One downside to equal weight portfolios is that they tend to have more risk (as measured by Standard Deviation) because they are investing more in smaller companies. Another concern is that they have less exposure to the biggest and best shares (i.e. the ones growing the quickest).