The Vanguard Australian Fixed Interest Index ETF (ASX: VAF) has performed strongly as falling bond yields have surprised economists and investors alike.

The latest yearly return number provided by Vanguard Australia (May 31, 2019) is a solid 8.8%. Remember, bond prices (and therefore bond ETFs) tend to move in the opposite direction to interest rates (i.e. lower interest rates = higher bond ETF prices).

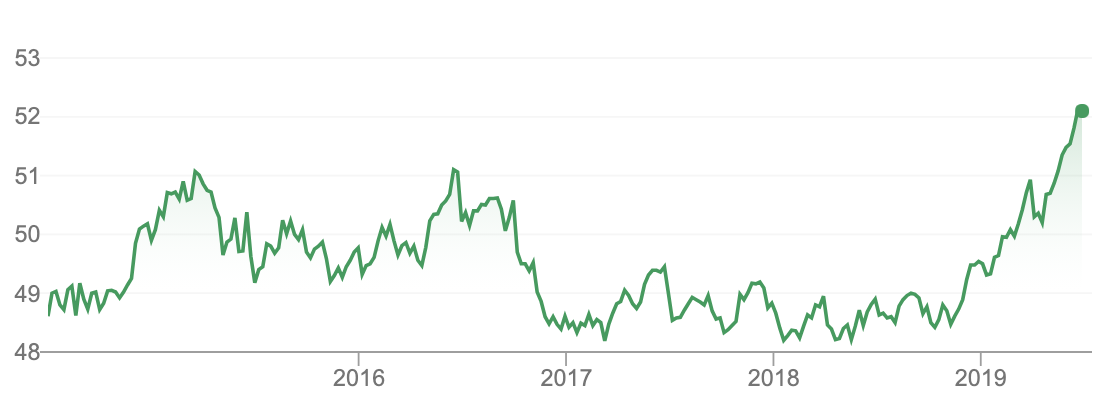

This chart shows VAF’s performance over five years:

The performance of VAF may surprise many investors who were reading about predictions early last year that bond yields would be heading higher. The popular opinion at the time was that the USA’s Federal Reserve’s tightening of monetary policy (i.e. increasing interest rates) would negatively impact the Australian bond market. The message was to temper/lower our expectations for returns from fixed-income investments such as VAF.

Don’t Get Whipsawed By Predictions

The fact that VAF delivered solid returns to defy the relatively gloomy forecasts for the fixed interest sector is worth reflecting on. It is a reminder to take macroeconomic forecasts with a pinch of salt.

If you get tempted to act quickly on the latest financial guru’s economic prediction, take some time out and get away from your trading screen. That may well cure your temptation and allow you to think longer term, rather than what may perform over the next few months.

Lower Bond Yields Ahoy?

After VAS has enjoyed such a good run over the last year the consensus views on bond yields appear to have changed. The articles I read now generally have a strong sense of complacency. They often suggest that yields could not possibly move higher over the next financial year.

Another sign of this complacency might be the money flowing into bond ETFs over 2019. This has been a global trend but is also noticeable with VAF. Looking at the securities outstanding announcements on this ETF — they are reflecting strong inflows. The VAF fund’s shares outstanding are more than 20% higher at the end of May compared with the start of the year.

Is The ‘Smart Money’ Right About VAF?

In my experience investors are more likely to do more harm than good if they place too much focus on such questions.

A better approach might be to understand what asset allocation targets are suitable for your own circumstances. Avoid the noise of listening to contrasting predictions from the financial media. Consider occasionally rebalancing ETF holdings such as VAF if they move meaningfully away from your targets.

That’s it.

[ls_content_block id=”695″ para=”paragraphs”]