Vanguard Diversified Conservative Index ETF (ASX:VDCO)

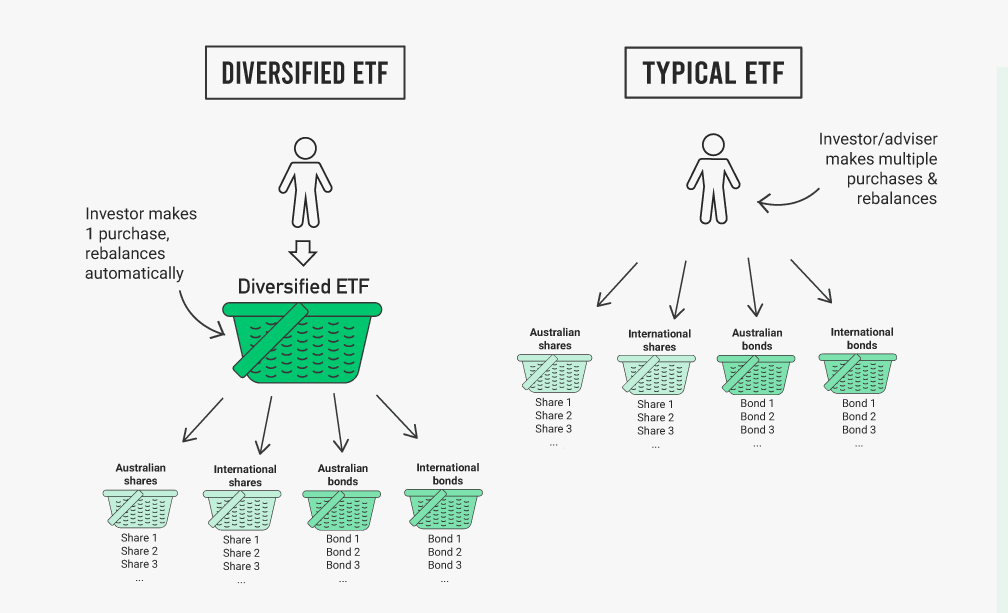

The Vanguard VDCO ETF provides investors with exposure to a portfolio of other Vanguard funds/ETFs, investing 30% in growth assets and 70% in defensive assets. Meaning, it’s an ETF which invests only in other funds/ETFs — in this case, it only invests in funds managed by its own provider, Vanguard. This ETF gives investors exposure to multiple asset classes with a single purchase, and is designed to be a diversified portfolio in itself.

VDCO ETF review

VDCO share price and fees

VDCO fees

Analyst report

The Vanguard Diversified Conservative Index ETF (ASX: VDCO) is a diversified ETF offered by Vanguard. VDCO is the most conservative of Vanguard’s diversified ETFs, investing 30% in growth assets (like shares) and 70% in defensive assets (like bonds).

VDCO is called a ‘diversified’ ETF because inside the ETF you will find that it holds a range of managed funds that invest across shares, bonds, and fixed-income securities. VDCO is what is sometimes referred to as a ‘fund of funds’, or an ETF that holds other ETFs or funds rather than individual securities like shares.

VDCO is currently invested across Australian shares, international shares, emerging markets, small-cap shares, bonds, and fixed-interest securities through seven Vanguard wholesale and retail managed funds. These funds are:

- Vanguard Australian Shares Index Fund (Wholesale)

- Vanguard International Shares Index Fund (Wholesale)

- Vanguard International Shares Index Fund (Hedged) – AUD Class (Wholesale)

- Vanguard Global Aggregate Bond Index Fund (Hedged)

- Vanguard International Small Companies Index Fund (Wholesale)

- Vanguard Emerging Markets Shares Index Fund (Wholesale)

- Vanguard Australian Fixed Interest Index Fund (Wholesale)

It is packaged as the simplest way to gain instant exposure to a diversified portfolio.

VDCO is the low-growth version of the Vanguard diversified ETFs, targeting an allocation of 30% growth and 70% defensive assets. Vanguard offers three more diversified ETFs, with the most growth-focused offering a 90% growth and 10% defensive allocation.

Alternatives

The competing ETFs in this relatively new diversified space are the BetaShares diversified ETFs, such as BetaShares Diversified All Growth ETF (ASX: DHHF) (100% growth assets), BetaShares Diversified Ethical High Growth ETF (ASX: DZZF) (90% growth assets), Betashares Diversified Growth ETF (ASX: DGGF), and BetaShares Diversified Balanced ETF (ASX: DBBF).

The BetaShares diversified range of ETFs has the advantage of owning other ETFs inside of them, whereas, as you read above, the Vanguard diversified range own managed funds. ETFs are more efficient from a tax perspective because the ETFs are separately held whereas a managed fund structure pools capital gains and creates “tax drag”.

That said, while BetaShares ETFs’ are worthwhile contenders and should be considered alongside Vanguard, we prefer the Vanguard ETF for a few reasons (fees, convenience and track record, to name a few).

My personal preference, and what I advocate for inside Rask Core 🌏 is that the Vanguard (and BetaShares) diversified ETFs are a fantastic way to start and build a portfolio. They’re especially useful for those just starting out or those who can’t be bothered creating their own portfolio of ETFs. However, if you have been investing for quite some time, are paying tax at a higher rate or feel that the allocations Vanguard uses aren’t ideal, it’s possible to build a diversified ETF portfolio for less than the cost of a diversified ETF from Vanguard.

VDCO: for retirees and extremely conservative investors

As it currently stands, we believe Vanguard diversified ETFs are the quickest and easiest way to gain access to a diversified portfolio covering shares, bonds, and fixed interest securities. This ETF was one of the first diversified ETFs to launch in Australia in November 2017, and has quickly grown to become a large ETF.

Vanguard’s track record as an issuer and its depth of experience speaks for itself and VDCO is an opportunity to get access to a selection of its wholesale funds normally reserved for institutional investors. While it may be possible to build an ETF portfolio with similar allocations for a slightly lower management fee, we believe the convenience of this ETF is well worth the modest management fee.

Another consideration is that, because all of the funds are held under one ETF, rebalancing is not an issue for the investor. For example, if you bought five ETFs covering Australian shares, international shares, emerging markets, bonds, and fixed interest, you would need to rebalance your ETF portfolio at least one or two times per year to maintain a target asset allocation. VDCO does this automatically for the investor, rebalancing as needed if any of its target allocations fall outside of the tolerance band, set at plus or minus 2%.

Risks

As mentioned, VDCO’s 30% allocation to growth assets (e.g. shares) means it may have lower volatility than many other ETFs but there is greater potential for below-average returns over the long run. Therefore, VDCO should only be considered by investors with an extremely low-risk tolerance or focus on stable income.

Remember, the more shares (as a % of a portfolio), the higher the level of risk you are taking. So be mindful of your risk tolerance before you invest in VDCO.

If this doesn’t sound like it is for you, Vanguard has designed three other diversified ETFs with different target allocations. The full range of Vanguard diversified ETFs may be better suited, depending on the investors risk tolerance, knowledge of investing and time horizon.

Other Vanguard Diversified ETFs (all links open in a new tab):

- Vanguard Diversified Conservative ETF – ASX:VDCO – 30% growth assets

- Vanguard Diversified Balanced ETF – ASX:VDBA – 50% growth assets

- Vanguard Diversified Growth ETF – ASX:VDGR – 70% growth assets

- Vanguard Diversified High Growth ETF – ASX:VDHG – 90% growth assets

Summary

VDCO is quite likely the easiest way to start investing in a low-growth but conservative portfolio right now. For a relatively low management fee, investors can get exposure to a range of wholesale and retail funds managed by one of the top investment funds in the world. The low growth allocation provides the potential for more stable returns in a 3-5 year period, while still paying quarterly dividends/distributions and providing some growth over its allocations to local and overseas share markets.

However, Vanguard VDCO may not be the right choice for investors with a medium risk tolerance or long-term investment horizon as the low growth profile may result in VDCO struggling to grow purchasing power over time.

Final point: we think the VDCO ETF is a great jumping-off point. It can be used to help an investor build the ‘Core’ or long-term Strategic Asset Allocation (or “SAA”, in financial planner speak). However, you might consider adding other ETFs to your portfolio, or outside of your brokerage account, to ensure you are still diversified across providers. A financial planner can help you explore the best option for you.

To join me inside Rask Core 🌏 and get all of our premium ASX research and model portfolios, click here.

Cheers!

Owen Raszkiewicz

Founder of Best ETFs Australia, lead analyst of Rask Core

Fee comparison

What does the VDCO ASX ETF invest in?

The VDCO ETF invests in a range of other wholesale and retail Vanguard funds, giving investors exposure to equities and fixed interest securities with a single purchase. This conservative ETF has a target weighting of 30% growth assets and 70% income assets.

What do investors use the VDCO ETF for?

The VDCO ETF might be used by investors who are wanting a simple way to establish a diversified portfolio with conservative weightings. This ETF may suit investors who are more focused on income than capital growth.

How to buy the VDCO ETF

A portfolio FULL of our best ETF ideas

Click the button to discover how you can create one account and get an automated professionally managed ETF portfolio.

VDCO investor starter pack

VDCO literature

VDCO holdings

ASX: VDCO’s dividend 2021

When does VDCO pay a dividend?

VDCO dividend reinvestment plan (DRP)

Warnings we apply to the VDCO ETF

VDCO tax domicile

VDCO ETF registry

Fund issuer

Diversified ETF sector data

How VDCO compares:

Latest ETF News

*The warnings on this page are applied by our ETF research team. Please know that these warnings are based on quantitative metrics and our internal methodology. These risks are not exhaustive and therefore they should not be relied upon. Always read the PDS of the function and speak to your financial adviser before acting on this information.

The Best ETF in Australia?

We’ve found the ONE ETF that could rule them all…

Right now, there are 200+ ETFs on the ASX. Then there are index funds. Hundreds of managed funds. LICs. REITs. And everything in between. Wouldn’t it be nice to make ONE investment and build the strong Core of your portfolio — with just one click?

Rask’s lead ETF research analyst and investing team have identified our #1 ETF for 2021 and beyond. Our analyst team has put together a full research report and a step-by-step investment guide to buying this ETF.

Best of all: The report is totally free and will be sent via email.

Unsubscribe anytime. Read our Terms, Financial Services Guide, Privacy Policy. We’ll never sell your email address. Our company is Australian-owned.