The Vanguard VDCO ETF provides investors with exposure to a portfolio of other Vanguard funds/ETFs, investing 30% in growth assets and 70% in defensive assets. Meaning, it’s an ETF which invests only in other funds/ETFs — in this case, it only invests in funds managed by its own provider, Vanguard. This ETF gives investors exposure to multiple asset classes with a single purchase, and is designed to be a diversified portfolio in itself.

The Vanguard Diversified Conservative Index ETF (ASX: VDCO) is a diversified ETF offered by Vanguard. VDCO is the most conservative of Vanguard’s diversified ETFs, investing 30% in growth assets (like shares) and 70% in defensive assets (like bonds).

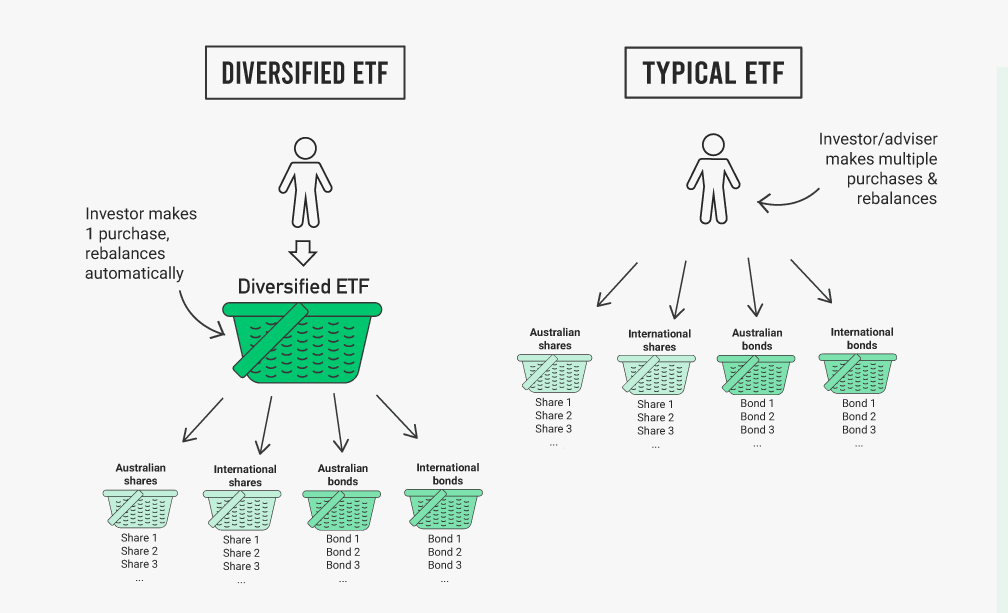

VDCO is called a ‘diversified’ ETF because inside the ETF you will find that it holds a range of managed funds that invest across shares, bonds, and fixed-income securities. VDCO is what is sometimes referred to as a ‘fund of funds’, or an ETF that holds other ETFs or funds rather than individual securities like shares.

VDCO is currently invested across Australian shares, international shares, emerging markets, small-cap shares, bonds, and fixed-interest securities through seven Vanguard wholesale and retail managed funds. These funds are:

It is packaged as the simplest way to gain instant exposure to a diversified portfolio.

The competing ETFs in this relatively new diversified space are the BetaShares diversified ETFs, such as BetaShares Diversified All Growth ETF (ASX: DHHF) (100% growth assets), BetaShares Diversified Ethical High Growth ETF (ASX: DZZF) (90% growth assets), Betashares Diversified Growth ETF (ASX: DGGF), and BetaShares Diversified Balanced ETF (ASX: DBBF).

The BetaShares diversified range of ETFs has the advantage of owning other ETFs inside of them, whereas, as you read above, the Vanguard diversified range own managed funds. ETFs are more efficient from a tax perspective because the ETFs are separately held whereas a managed fund structure pools capital gains and creates “tax drag”.

That said, while BetaShares ETFs’ are worthwhile contenders and should be considered alongside Vanguard, we prefer the Vanguard ETF for a few reasons (fees, convenience and track record, to name a few).

My personal preference, and what I advocate for inside Rask Core 🌏 is that the Vanguard (and BetaShares) diversified ETFs are a fantastic way to start and build a portfolio. They’re especially useful for those just starting out or those who can’t be bothered creating their own portfolio of ETFs. However, if you have been investing for quite some time, are paying tax at a higher rate or feel that the allocations Vanguard uses aren’t ideal, it’s possible to build a diversified ETF portfolio for less than the cost of a diversified ETF from Vanguard.

Vanguard’s track record as an issuer and its depth of experience speaks for itself and VDCO is an opportunity to get access to a selection of its wholesale funds normally reserved for institutional investors. While it may be possible to build an ETF portfolio with similar allocations for a slightly lower management fee, we believe the convenience of this ETF is well worth the modest management fee.

Another consideration is that, because all of the funds are held under one ETF, rebalancing is not an issue for the investor. For example, if you bought five ETFs covering Australian shares, international shares, emerging markets, bonds, and fixed interest, you would need to rebalance your ETF portfolio at least one or two times per year to maintain a target asset allocation. VDCO does this automatically for the investor, rebalancing as needed if any of its target allocations fall outside of the tolerance band, set at plus or minus 2%.

As mentioned, VDCO’s 30% allocation to growth assets (e.g. shares) means it may have lower volatility than many other ETFs but there is greater potential for below-average returns over the long run. Therefore, VDCO should only be considered by investors with an extremely low-risk tolerance or focus on stable income.

Remember, the more shares (as a % of a portfolio), the higher the level of risk you are taking. So be mindful of your risk tolerance before you invest in VDCO.

If this doesn’t sound like it is for you, Vanguard has designed three other diversified ETFs with different target allocations. The full range of Vanguard diversified ETFs may be better suited, depending on the investors risk tolerance, knowledge of investing and time horizon.

Other Vanguard Diversified ETFs (all links open in a new tab):

VDCO is quite likely the easiest way to start investing in a low-growth but conservative portfolio right now. For a relatively low management fee, investors can get exposure to a range of wholesale and retail funds managed by one of the top investment funds in the world. The low growth allocation provides the potential for more stable returns in a 3-5 year period, while still paying quarterly dividends/distributions and providing some growth over its allocations to local and overseas share markets.

However, Vanguard VDCO may not be the right choice for investors with a medium risk tolerance or long-term investment horizon as the low growth profile may result in VDCO struggling to grow purchasing power over time.

Final point: we think the VDCO ETF is a great jumping-off point. It can be used to help an investor build the ‘Core’ or long-term Strategic Asset Allocation (or “SAA”, in financial planner speak). However, you might consider adding other ETFs to your portfolio, or outside of your brokerage account, to ensure you are still diversified across providers. A financial planner can help you explore the best option for you.

To join me inside Rask Core 🌏 and get all of our premium ASX research and model portfolios, click here.

Cheers!

Owen Raszkiewicz

Founder of Best ETFs Australia, lead analyst of Rask Core

The VDCO ETF invests in a range of other wholesale and retail Vanguard funds, giving investors exposure to equities and fixed interest securities with a single purchase. This conservative ETF has a target weighting of 30% growth assets and 70% income assets.

The VDCO ETF might be used by investors who are wanting a simple way to establish a diversified portfolio with conservative weightings. This ETF may suit investors who are more focused on income than capital growth.

To invest in any ASX ETF, you need to use create your own broker account and choose from over 400 ETFs.

But why bother do that when you can get everything done for you – for a simple, low, fee?

We manage ETF portfolios on behalf of 250+ Australian investors, with over $20 million invested.

Simple. Low cost. Transparent. Professional.

It’s called Rask Invest.

Click the button to discover the ETFs we own, and how it works.

*The warnings on this page are applied by our ETF research team. Please know that these warnings are based on quantitative metrics and our internal methodology. These risks are not exhaustive and therefore they should not be relied upon. Always read the PDS of the function and speak to your financial adviser before acting on this information.

The information on this website is general financial advice only. That means, the advice does not take into account your objectives, financial situation or needs. Because of that, you should consider if the advice is appropriate to you and your needs, before acting on the information. In addition, you should obtain and read the product disclosure statement (PDS) before making a decision to acquire any financial product. If you don’t know what your needs are, you should consult a trusted and licensed financial adviser who can provide you with personal financial product advice. Please read our Terms & Conditions and Financial Services Guide before using this website.

“Rask Invest” is considered a financial product and has a Product Disclosure Statement (PDS) and Target Market Determination (TMD), issued by InvestSMART. These documents can be accessed on the Rask Invest website. Please seek professional advice before making any investment decision with respect to Rask Invest.

© Rask Australia 2024